The Increasing Impact of an Endowment

With an endowment, the principal is never spent. Rather, the beneficiary receives a specified income that may be used for a specific or general purpose, according to the donor’s wishes.

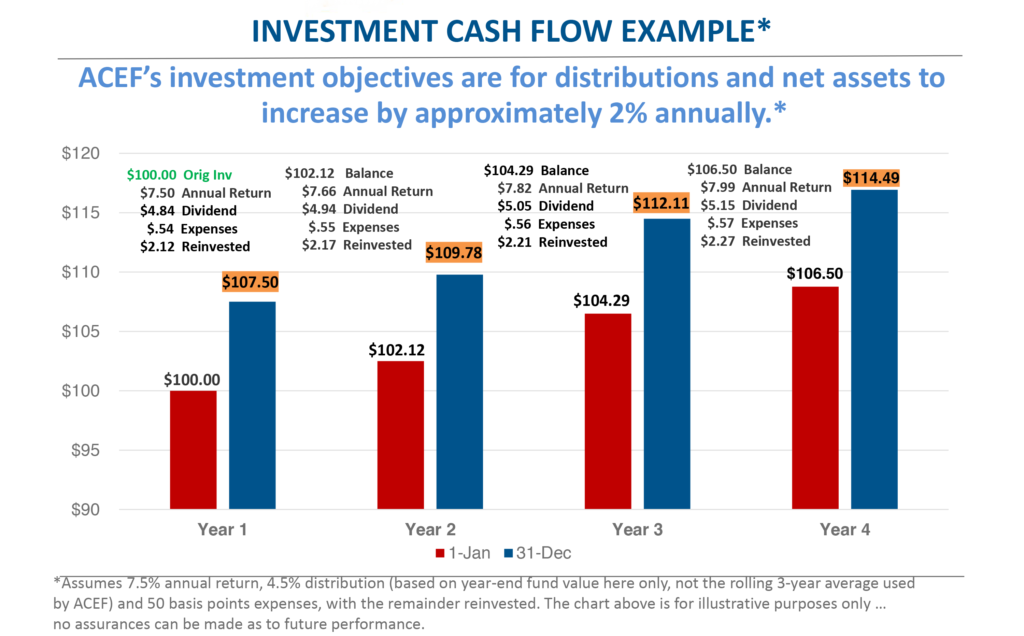

Currently, funds managed by ACEF aim to distribute approximately 4.5% income each year (based on a rolling 12-quarter average) to beneficiaries per the donor’s or investor’s instructions. Any additional income earned is added to the original fund as undistributed earnings and reinvested, helping maintain distributions during those years when financial returns may be poor. Over time, as the principal of the endowment increases, so do the distributions.

Demonstrating the Growth of an ACEF Endowment (net of distributions)*

Although an endowment fund with ACEF can start with as little as $5,000, for this example, let’s consider an endowment with an initial value of $100,000. As noted in the chart below, the total value of this fund will reach $114,490 in year 4 with a 4.5% distribution taking place every year.* This example assumes no other parishioner or organization creates a new endowment or contributes to an existing one for 4 years.

*Assumes a real return of 7.5% based on ACEF’s current policy asset allocation and an assumed inflation rate of approximately 2%. Annual distributions, based on 4.5% of the average market value over the trailing 12 quarters, would total $114,500. The chart above is for illustrative purposes only … no assurances can be made as to future performance.

ACEF will advise you on how to set up an endowment properly.