The Numbers Make the Case

ACEF has generally outperformed the market and has provided growth and stability to individual parishes and other Church-related institutions: Since 1Q 1999, ACEF’s returns have been closely in line with the market as well as our benchmark (as of December 31, 2017):

Annualized return:

ACEF — 5.83%

Benchmark — 5.95%

S&P 500 — 5.98%

Income to parishes

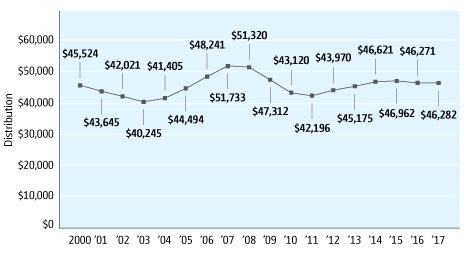

If you are one of the parishes in our community who had a $1 million endowment fund in 2000, the following chart shows what you received in income from that endowment through 2017. The total income from these endowments honors the wishes of individual donors, and also represents a very significant contribution toward the annual operating costs of your parish. Remember, a parish’s total endowment may be made up of various individual, named endowments.

The numbers make the case (income to parishes)

Actual distributions from an endowment of $1,000,000 beginning in 2000* *Actual historical ACEF quarterly returns and market values used to generate distribution figures. Assumes 4.5% distribution rate.

If investments generate more than 4.5% return, this extra income is reinvested. This ensures that beneficiaries will receive a distribution in years when the financial markets are not doing well.